As we have seen in recent years, many new traders get caught chasing the latest vogue stock or asset class, crypto currencies being a great example. Led by hysteria and bogus dogmas such as ‘diamond hands’ and ‘laser eyes’ which are used to ‘teach’ retail traders into a ‘buy and hold’ strategy (i.e., do not sell).

But as Bitcoin fell from a peak of $68,999 late last year to $32,970 just 2 months later, many retail traders were wiped out. In fact, on chain analytics showed us that on May 19th, 2021 (a day of great crypto volatility) 880,000 crypto trades lost their entire equity.

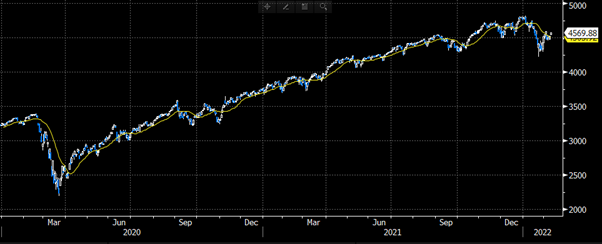

More recently with the S&P composite index trading just 6.2% below it’s all time high (4th January 2022) the internal breakdown of individual stocks is showing far greater weakness.

Recently ‘meme’, crypto, and work from home stocks such as Peloton, Dogecoin, Nikola and Robinhood have all fallen more than 85% from their 2021 peak.

More recently with the S&P composite index trading just 6.2% below it’s all time high (4th January 2022) the internal breakdown of individual stocks is showing far greater weakness.

Recently ‘meme’, crypto, and work from home stocks such as Peloton, Dogecoin, Nikola and Robinhood have all fallen more than 85% from their 2021 peak.

The key to successful trading is risk management, particularly cutting losses and holding profitable trending positions.

However, this is easier said than done, and our own behavioral biases such as loss aversion, prospect theory, self-attribution, over-trading and over-confidence continually work against us.

Related article: Trading and Investing: A Beginner's Guide

However, this is easier said than done, and our own behavioral biases such as loss aversion, prospect theory, self-attribution, over-trading and over-confidence continually work against us.

Related article: Trading and Investing: A Beginner's Guide

Understanding our behavioral biases and controlling our emotions are also key. As Marty Schwartz, a famous stock trader once said;

“Most people think they’re playing against the market, but the market doesn’t care. You’re really playing against yourself.”

Here are some key trading tips for new and aspiring traders.

1 Follow the Trend

2 Use a Stop Loss to Exit Losing Positions

3 Never Average Down

4 Stay Patient

5 Have a Process

6 Mind Your Risk

7 Develop Your Trading Knowledge

8 Take Your Time