Stephen Murphy

Tips for New Traders – Err on The Side of Caution

With an increase in the number of people on Covid-19 pandemic supports due to reduced employment levels, broader access to commission-free trading and a strong couple of months in the market, there has been a huge increase in day trading.

What is driving this surge?

One of the biggest factors driving share prices higher is a dramatic increase in speculative buying of stocks by new and inexperienced investors, encouraged by commission-free trading platforms, together with an explosion in financial tips on social media platforms such as Twitter, TikTok, and Reddit, often by individuals with very limited investing knowledge and no knowledge of the risks involved.

The market’s volatility since the onset of the global pandemic has made trading especially enticing. With professional sports having largely been on pause and group gatherings discouraged, users have flocked to day-trading apps to cure isolation and boredom from lockdown.

With many stalwarts of the tech industry trading at astronomical valuations, day traders have turned their attention to the other end of the spectrum, focusing on low-priced stocks (or penny stocks as they used to be known) which are often highly illiquid.

By using social media channels, retail investors are building support for unloved stocks – often with poor balance sheets and a history of losses – to buy in a concerted way and send the shares higher.

This surge in day trading is not only evident in the US and Europe. In Southeast Asia, the Stock Exchange of Thailand recently noted that the Thai market currently has 4.38 million trading accounts in the system. The number of investors has soared by 45% or 800,000 people - the highest jump in decades - from 1.8 million pre pandemic to 2.6 million people at present.

The role of SPACs

Market speculators are also being drawn to Special Purpose Acquisition Companies (SPACs), of which more than 320 have listed in the United States this year alone.

A special purpose acquisitions company is essentially a shell company set up by investors with the sole purpose of raising money through an IPO to eventually acquire another company. Many have no revenues, yet their shares have been supercharged by hordes of buyers desperate for some new investment opportunity and speculating over what these cash shells might buy.

Speculation in assets such as penny stocks and SPACs has reached levels rarely seen in the past and only seen in the final stages of a stock market bubble, where higher prices are sustained not by fundamentals but by faith that a ‘greater fool’ will pay an even higher price.

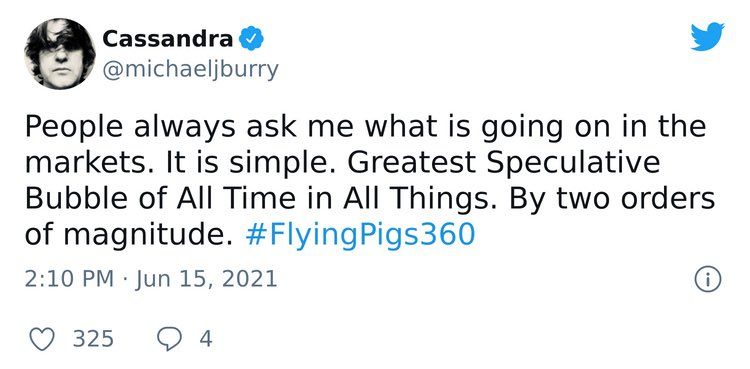

Burry gives his take

After a 3-month absence, renowned investor Michael Burry - who was portrayed by Christian Bale in the movie "The Big Short" - announced his return to Twitter warning his followers about the largest market bubble in history.

However, it is not only Burry who is waving the warning flags, market commentators are increasingly driving the narrative that there are market bubble red flags visible across several verticals.

Knowledge is the first port-of-call for success

Regardless of your motivation to trade, your success will largely be determined by the underlying knowledge you use to make trading decisions.

As fresh-faced retail investors increasingly flock to the stock and digital asset market amid the pandemic, more and more industry leaders, including Paiboon Nalinthrangkurn, chairman of the Federation of Thai Capital Market Organizations, are urging inexperienced investors to educate and subsequently protect themselves from risks in a digitalized market.

Young investors routinely opt for high-risk assets, but a large majority are unsure of how to adapt their strategies to protect against losses in the current financial climate. Knowledge can help mitigate this risk.

Newly published research from Charles Schwab UK on Millennial & Gen Z investors found that more than 70% of young investors admit they are unsure of how to adapt their strategies to protect against losses.

I would echo the comments of Charles Schwab UK Managing Director Richard Flynn in encouraging inexperienced investors to exercise caution and engage in formal trading education.

“We would encourage any new, inexperienced investors to learn as much as possible about different assets prior to making any investment, especially if they find it difficult to make investment decisions.”

The benefits of formal trading education

Online trading courses may come with an upfront cost, but what they offer in structure and support is invaluable.

The following are some of the key benefits from engaging in formal trading education:

1 Knowledge

The stock market is no different to a battlefield. While you are trading, you are essentially pitted against smart and experienced traders. If you are to win this battle, you must be better than them. A trading course will give you in-depth knowledge around stock trading and the necessary tools and techniques required for success.

2 Risk Management

Education will enable you to understand the risks of the market and how to stay protected against possible downside on your investments.

Utilizing and understanding active and passive trading strategies can help you achieve your targets.

Utilizing and understanding active and passive trading strategies can help you achieve your targets.

3 Speed

In the stock markets, opportunities do not last forever. This means you need to be quick to capitalize, or you will miss opportunities. To trade at speed, you need to be confident in your ability. Formal stock trading education is vital when building confidence.

4 Avoid Common Pitfalls

You will get to know the mistakes traders make allowing you to stay safe and hopefully in the green.

Conclusion

I will leave you with a quote from the ancient Chinese military strategist Sun Tzu ~

“He will win who, prepared himself, waits to take the enemy unprepared.”

The two gems of wisdom we can find from this proverb are:

- Traders should always do their own homework and be prepared for a setup or strategy

- Traders should be prepared to face any eventuality (such as a stock market crash)