The future of money is uncertain, along with our understanding of how to best associate and assign value to it. The growth of digital finance over the past decade has slowly begun to reshape the conceptual boundaries of currencies, challenging at the same time the very institutional structures that validate and issue them.

Though cryptocurrencies often represent a kind of lawless and unregulated departure from traditional finance, the technologies that define them are only beginning to be explored for the potential they represent.

This has transcended the fanaticism of recreational, would-be traders, landing instead atop the meeting agendas of the world’s biggest banks.

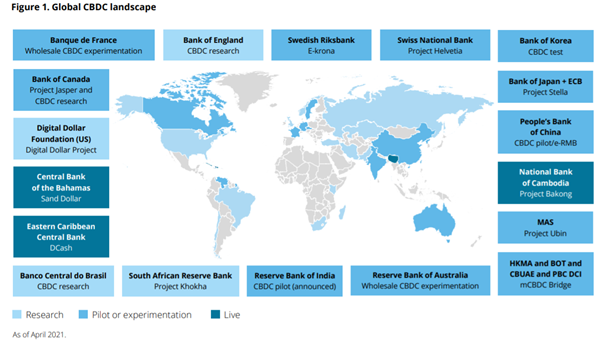

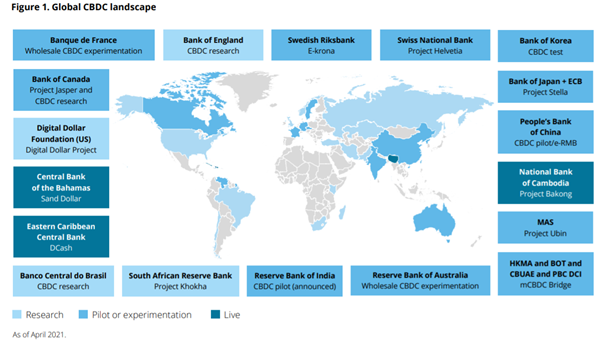

Dozens of central bank pilot schemes have taken flight in the past number of years, with countries aiming to test the waters for what might represent the future of the industry. But it’s a stark change, and one that doesn’t come without challenges.

Fiat currencies retain value in the confidence and trust they inspire among their user base. So, the question must be asked of how people might trust these systems, and the speculative progress they represent.

This article examines some of the developments in this area, contrasts some of their nuances, and highlights what it means for educators and learning within the industry going forward.

The digital agenda reshaping the world of finance has found its star player in cryptocurrencies.

Commodities like Bitcoin and Ethereum operate in a remote capacity, not belonging to or falling under the oversight of any governing body. I’ll hesitate to define them as assets for the time being. Currently they’re useful in so far as what they offer as vehicles of speculation, but characteristically still lack the defining features for what we think of as “Money”.

Related article: The State of Crypto in 2022: Everything You Need to Know

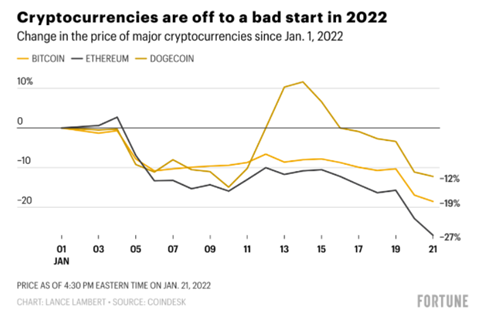

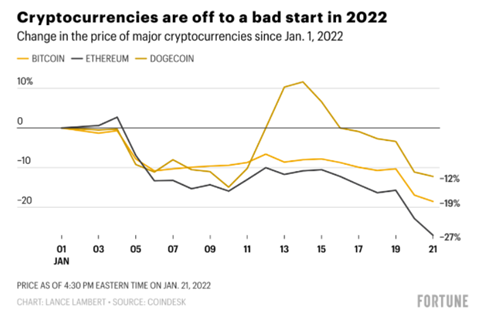

Being decentralized places them outside the remit of regulators. Uncaged, their value can float, spike, and freefall almost sporadically, with crashes having previously wiped $200 billion off the market in the course of single day.

As these technologies become more meaningfully integrated within society and their applications become more transferable, legacy institutions in central banks have begun to experiment with their own view of creating more stable alternatives.

Related article: Understanding Cryptocurrencies - The Importance of Financial Literacy for the Part-Time InvestorCentral Bank Digital Currencies (CBDCs) capture the concept of digital money in a similar, but more contained way to cryptocurrencies.

Cryptocurrency prices are fragile, and often tend to be dictated by arbitrary sources. Sometimes with significant price fluctuations accountable to the character limits imposed by Twitter, and certain individuals’ ability to almost satirically work around them.

CBDCs might incidentally offer a practical step beyond the sensationalism and hysteria.

In theory at least, CBDCs serve a number of purposes which reflect the established practicality of the physical, cash alternatives they represent.

They have the potential to support the digitization of economies, as we graduate towards cashless substitutes and digital payment channels which help to streamline best practices for exchange. On a macro scale, they may even help facilitate more effective forms of monetary and fiscal policy.

Related article: Private Cryptocurrencies: Useful or Dangerous?Central banks will have more uninterrupted access to consumer segments, simplifying the distribution of government benefits across populations cohorts.

In terms of accessibility, CBDCs could democratize the strength of local currencies, specifically among those that have traditionally relied on the likes of the US dollar as an exchange crutch.

Iterative improvements are being made and best practices being established as countries test the boundaries for these technologies.

Source: Deloitte – Central Bank Digital Currencies: The Next Disruptor (September 2021).

The Central Bank of the Bahamas issued a digital equivalent in the form of the Sand Dollar, which has proven remarkably successful over the past number of years - serving as a developmental milestone of sorts.

Operationalizing this digital currency meant scaling across territories. The Bahamas made for a perfect opportunity to effectuate meaningful change across disparate population groups.

Incidentally, the issuance of the Sand Dollar has provided a new financial alternative to rural island groups, who otherwise fell outside the purview and care of traditional, physical banking channels.

Though the proverbial flood gates are yet to be opened, dozens of other nations are edging towards similar solutions.

Here we can look to China with their e-CNY, or India with talks of their e-rupee gesturing towards market over the next few years.

While emerging markets pioneer these standards for the cost-effective options they represent, more established economies in the US and UK caution skepticism and remain hesitantly ambivalent on bolting before the gun.

But whether these technologies are rolled out on an international scale might be more a matter of ‘when’ than ‘if’.

Admittedly there’s a lot to weigh up. Cryptocurrencies have disrupted any traditional and romantic understanding of ours for “what goes” in finance. It’s a restless space that’s sure to evolve continuously, and with equal disregard for how well we understand it.

CBDCs may offer an alternative in the future as the way forward for digital currencies, with countries issuing their own pilot schemes backed against domestic reserves.

Our understanding for financial literacy will continue to transform and account for the pace of technological change as the needle moves, and a new generation of financial instruments round the corner.

To the same effect, governments will have to take onus upon themselves to market these offerings responsibly, and in a way that educates consumer segments on a large scale.

Successful pilot schemes will ask questions of how effectively these new technologies can be communicated across different population groups. Including older users and those disaffected by a lack of technological infrastructure.