While U.S. equities march to new all-time record high levels and U.S. house prices see record gains with existing home prices rising 23.5% YoY, people would easily think the global economy is in good health after the COVID-19 crisis.

Indeed, central banks and government around the world continue their mix of massively stimulatory monetary and fiscal policies. In fact, the U.S. Federal Reserve alone is still injecting $120 billion per month into asset prices with its on-going quantitative easing (QE) policy.

Indeed, central banks and government around the world continue their mix of massively stimulatory monetary and fiscal policies. In fact, the U.S. Federal Reserve alone is still injecting $120 billion per month into asset prices with its on-going quantitative easing (QE) policy.

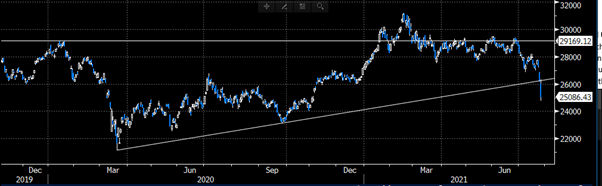

However, below the surface the data shows the strength of the recovery is clearly eroding. Global purchasing managers indices (PMI) are now falling, and the Citibank economic surprise index shows economic data at its most disappointing levels since June 2020.

However, the greatest concern is likely events in China, the economy that led the global economy out of the Global Financial Crisis.

Firstly, we have seen a China credit bubble start to burst in the last few weeks with the China credit impulse falling aggressively and the collapse of Evergrande’s bonds (China’s most leveraged property developer) trading below 50c on the dollar as Hong Kong backs pull-back financing. Its bonds now yield over 55%.

Firstly, we have seen a China credit bubble start to burst in the last few weeks with the China credit impulse falling aggressively and the collapse of Evergrande’s bonds (China’s most leveraged property developer) trading below 50c on the dollar as Hong Kong backs pull-back financing. Its bonds now yield over 55%.

Cracks Emerging in Asia and Emerging Market Economies